Luxembourg has long been recognized as a global economical hub, featuring a sturdy regulatory framework and appealing tax Advantages. Amongst the different constructions obtainable for Global traders and organizations, the Luxembourg Holding Soparfi (Société de Participations Financières) is usually a extremely favored motor vehicle for holding businesses. Noted for its overall flexibility and tax efficiency, registering a Soparfi in Luxembourg is often a fantastic choice for All those planning to enhance their Intercontinental investments.

In this article, We are going to investigate the key positive aspects, prerequisites, and steps to registering a Luxembourg Holding Soparfi, and how this framework can reward firms and traders.

What exactly is a Soparfi?

A Soparfi is often a economic Keeping organization included beneath Luxembourg legislation. It truly is primarily made for the holding of shares or other financial assets in subsidiaries. The Soparfi construction is flexible, presenting several pros for Intercontinental investors trying to handle their investments, improve their tax positions, and gain from Luxembourg’s favorable small business atmosphere.

Luxembourg’s tax regime features substantial positive aspects for Soparfi corporations. Such as, the participation exemption will allow Soparfi firms to be exempt from tax on qualifying dividends and capital gains, offered certain situations are met. This makes it a really perfect structure for holding and taking care of investments throughout borders.

Critical Advantages of a Luxembourg Keeping Soparfi

Tax Efficiency: The Soparfi enjoys various tax advantages, which includes exemptions on dividends and capital gains, delivered that the ailments are achieved (e.g., bare minimum shareholding percentages and holding intervals). This can make the framework desirable for international investors seeking to minimize their tax liabilities on cross-border investments.

Double Tax Treaty Network: Luxembourg has signed double taxation treaties with many international locations, which helps mitigate the potential risk of double taxation on dividends, interest, and money gains. This comprehensive treaty network is a major advantage for organizations and investors applying Luxembourg as a Keeping corporation jurisdiction.

Asset Security: The Soparfi framework gives adaptability in running property and liabilities, making it possible for for effective asset protection. The separation of Keeping and operating actions ensures that liabilities connected with operating organizations can be retained at a length through the holding corporation.

Adaptability and Simplicity of Administration: A Soparfi is comparatively simple to manage and may be used for a variety of purposes, together with holding shares in other providers, investments in real estate property, and managing intellectual property rights. The composition presents flexibility in its governance, rendering it simpler to adapt to modifying enterprise demands.

Privacy and Confidentiality: Luxembourg's lawful procedure offers a substantial degree of confidentiality, which may be effective for Global investors who prefer to maintain their financial affairs private.

Measures to Sign-up a Luxembourg Holding Soparfi

Choosing the Correct Authorized Variety: Step one in registering a Soparfi is to settle on the right legal type. The most typical form to get a Soparfi can be a restricted legal responsibility corporation (S.A.R.L.) or possibly a general public restricted firm (S.A.). The choice depends upon the specific requirements of your organization and its shareholders.

Share Capital Specifications: A Soparfi have to have a minimal share money, typically €31,000 for an S.A. and €twelve,000 for an S.A.R.L. This cash is usually in the shape of cash or assets.

Drafting the Articles or blog posts of Association: The subsequent action would be to draft the organization’s content articles of Affiliation, which outline the organization’s governance, shareholder legal rights, and operational procedures.

Notary Community and Registration: Once the content articles of association are geared up, they have to be notarized. The business must then be registered Together with the Luxembourg Trade and firms Register, a need for lawful existence.

Tax Registration: After the company is registered, it will have to also sign-up for taxation uses Together with the Luxembourg tax authorities. Dependant upon the functions from the Soparfi, other permits or registrations may very well be demanded.

Ongoing Compliance: After the Soparfi is operational, it ought to adjust to Luxembourg’s ongoing regulatory and reporting demands, such as fiscal statements, tax filings, and corporate governance obligations.

Why Pick Luxembourg for Your Holding Firm?

Luxembourg’s secure political setting, extremely designed money sector, and Trader-welcoming rules ensure it register luxembourg holding Soparfi is a lovely jurisdiction for Keeping businesses. Furthermore, the nation’s tax treaties along with the participation exemption supply superb alternatives for reducing the general tax load on world-wide investments.

For more in-depth information on registering a Soparfi in Luxembourg, including the unique Gains and tax strengths, it is possible to make reference to the thorough information offered on Damalion's Site. This guideline supplies action-by-stage instructions and skilled insights to assist you navigate the registration method smoothly.

Summary

Registering a Luxembourg Holding Soparfi is usually a extremely strategic selection for international buyers searching for a tax-economical and flexible composition for running their investments. With its quite a few benefits, which include tax exemptions, asset defense, and a robust regulatory framework, the Soparfi is Probably the most beautiful selections for Keeping firms in Europe. By next the appropriate methods and leveraging the knowledge of specialists, you may correctly sign-up your Soparfi and gain from everything Luxembourg has to offer.

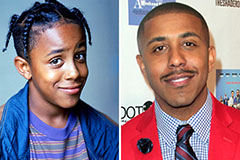

Marques Houston Then & Now!

Marques Houston Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now! Tina Majorino Then & Now!

Tina Majorino Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now!